It’s time to change the way we charge for architecture

Data continues to show architects and designers earn less than professionals in other industries - rethinking how we charge for architecture can reverse this trend.

The architecture profession – like many other professions – hasn’t always had an easy relationship with pricing. Caught somewhere between the subjective world of pricing art and the ruthless time-charge model of the legal profession, architecture tries to walk a line between charging for the cost incurred and the value created. And it attempts to do all this with a rather crude pricing mechanism.

The idea that the price of architecture could be thought of as a percentage of construction cost can be traced back to 1857, when Richard Morris-Hunt (the co-founder of the American Institute of Architects) sued a client for non payment of his fee. The court agreed that 5 per cent of the construction budget was fair and reasonable and, thus, an industry benchmark was established.

Over the next hundred or so years, as part of their remit to ensure quality across the profession, architecture institutes around the world played a watchdog role of sorts – vigilant to anyone deemed to be discounting or undercutting the market.

From the 1970s onwards, however, the practice of non-price competition came into focus under the Sherman Antitrust Act. In 1972, and again in 1990, the American Institute of Architecture – like many other professional bodies — had injunctions brought against it by the Department of Justice concerning the anti-competitive nature of its suggested fee schedules. As a result, today most institutes around the world are now very reticent to provide any guidance or commentary on fees.

For some clients, this has turned negotiating architecture fees into a kind of one-sided blood sport where the referee has been muted. Architects must deliver a minimum standard of quality in accordance with their professional obligations, but are left to fight for their remuneration in the free market. This means clients can negotiate aggressively, safe in the knowledge that at least a minimum level of quality can be assured.

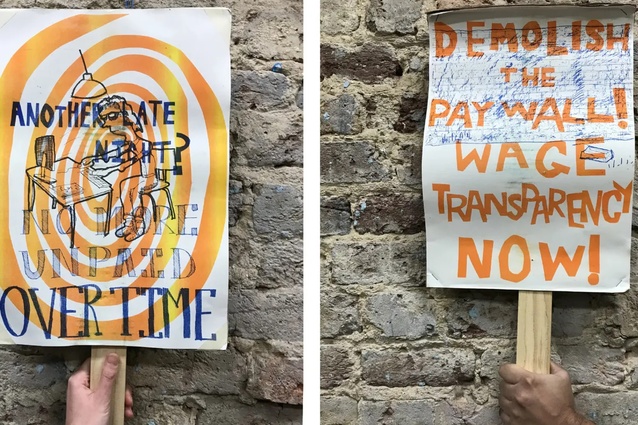

As a result, over the last 30 years, we have largely witnessed an erosion of fees and working conditions in the industry. Data from Seek continues to show architects and designers earn less than professionals in other industries across almost every category. And the problem is not contained in New Zealand. In 2021, Architectural Workers United was formed in New York as a direct response to the long hours and poor pay prevalent in the industry.

There is a myriad of reasons for this, but one well within the control of architects themselves is the fee mechanism itself. For architecture to thrive in a world of increasing compliance and automation, there is a pressing need for a mechanism that recognises the value created, not just the cost incurred.

To figure out what this might be, I studied pricing across different service businesses. The usual suspects of accounting, law and engineering didn’t have much to offer. They all have similar time-charge models and, perhaps unsurprisingly, are all facing similar fee and working condition erosions, they just started from a higher base.

I found something of interest, however, when I looked at how the other group of black t-shirt wearers charge – hedge fund managers. Perhaps controversially, I believe architecture has far more in common with hedge fund managers than lawyers.

In its purest form, architecture, like investing, is the unbridled pursuit of opportunity. Lawyering, engineering and accounting, on the other hand, are largely focused on the mitigation of risk.

Neither is better or more valuable than the other, but it’s instructive to understand the game that’s being played when attempting to figure out a fair reward for performance. Sticking with the sports analogy, you pay architects to kick goals, not defend them and every striker in the premier league has a goal bonus in their contract. So, too, it turns out, do hedge fund managers.

Towards a Two and Twenty

Hedge fund managers have their industry pricing mechanism. It’s called the two and twenty and it’s a compensation structure, consisting of a management fee and a performance fee. Two per cent represents a management fee that accounts for costs incurred and 20 per cent is the performance fee charged on the profits that the hedge fund generates, usually beyond a specified minimum threshold.

Using this model in architecture is obviously not quite as straightforward, given the return generated is not as simple to calculate – but it can be done. Take the new Dunedin Hospital for example, the client RFP had the stated objective of reducing clinicians’ non-value added time by 20 per cent. Presumably, this is the time doctors and nurses waste navigating the inefficiencies of a poorly designed hospital.

Applying the two and twenty would see the architect take two per cent to cover costs and twenty per cent of the savings on the operational expense should the target be achieved. There is a multitude of ways the 20 per cent could be structured and paid. However, the idea that a design brief should include a stated objective, an agreed measurement of that objective, and a performance-based fee sounds like a way the industry could make a quantum leap forward in both performance and remuneration.

If it sounds complicated, consider we’re already doing it in reverse. Before a project starts, there can be months of negotiating a contract and this is typically done with a unilateral focus on what happens if something goes wrong. Lawyers on both sides debate the interpretation of minimum standards, liability is fought over and insurance certificates are cited. Is it a stretch to imagine that – during this legal melee – we could slip in a few clauses covering what might happen if something goes better than expected?